Please follow us on Gab, Minds, Telegram, Rumble, GabTV, Truth Social, Gettr

Nexo, a Bulgarian-owned crypto-currency platform with close links to Sam Bankman Fried’s FTX platform, is under investigation by Bulgarian authorities. Siika Mileva, a spokesperson for the Prosecutor General’s office in Sofia, made the announcement on Thursday. Two Nexo offices in the Bulgarian capital were raided by the authorities earlier in the day.

The Bulgarian Prosecutor’s Office, working together with International law enforcement agencies, is investigating accusations of money laundering, tax crimes, and other offenses against Nexo. Mileva added that Nexo has handled over 94 billion dollars in assets and added that one of its largest clients has been accused of funding terrorist activites. Mileva did not name the investor in question.

Nexo’s Bulgarian founders Kosta Kantchev, Antoni Trenchev (former MP from the Reform Bloc political union) and Georgi Shulev are suspected by authorities of having embezzled several billion dollars in assets by urging depositors to invest in Bitcoin and other crypto-currencies, promising high profits.

An article posted to financialfraud.lawyer on November 30, 2022, drew parallels between Nexo and FTX, laying out the Ponzi-style foundation for the platform: “Nexo will continue to have an advantageous position in the market as long as the number of individuals investing in its token and platform remains higher than the number of individuals wishing to withdraw liquidity. This makes sense as the cash that can be withdrawn will come from new investments and investors.”

Investors have filed several lawsuits against Nexo. Recently, a group of Irish investors accused the company of freezing their accounts and forcing them to sell at prices far-below market value, resulting in losses of over 59 million dollars. While Nexo operates its business from Sofia, it does not offer its services within Bulgaria.

Nexo withdrew from the U.S. market in the fall of 2022 on the eve of the FTX collapse, due to legal action taken by the prosecutors in New York, who indicted the crypto company for “illegal operations and defrauding investors.” California, Vermont, Oklahoma, Kentucky, Washington, South Carolina, and Maryland had also ordered the company to stop offering its deposit products in their states.

Similar to Bankman-Fried’s operation, Nexo used the crisis in Ukraine as cover for its allegedly fraudulent activities. As part of a PR effort to counter the intensifying pressure from investigators, the company only yesterday posted on Twitter, “After the beginning of the horrible war in Ukraine, the first order of business was to help fundraise for those affected.”

In a veiled attack on Bulgarian authorities, the company also tweeted on Thursday, “Unfortunately, with the recent regulatory crackdown on crypto, some regulators have recently adopted the kick first, ask questions later approach. In corrupt countries, it is bordering with racketeering, but that too shall pass.”

FTX had announced in December 2021 that it would list the NEXO spot market. In January 2022, both FTX and Nexo announced they were launching Crypto Debit Cards. Interestingly, both companies shared the same auditor, California-based Armanino, which announced in December that it would be exiting the space. Armanino took this decision after being named, along with FTX and Bankman-Fried, in a class action lawsuit.

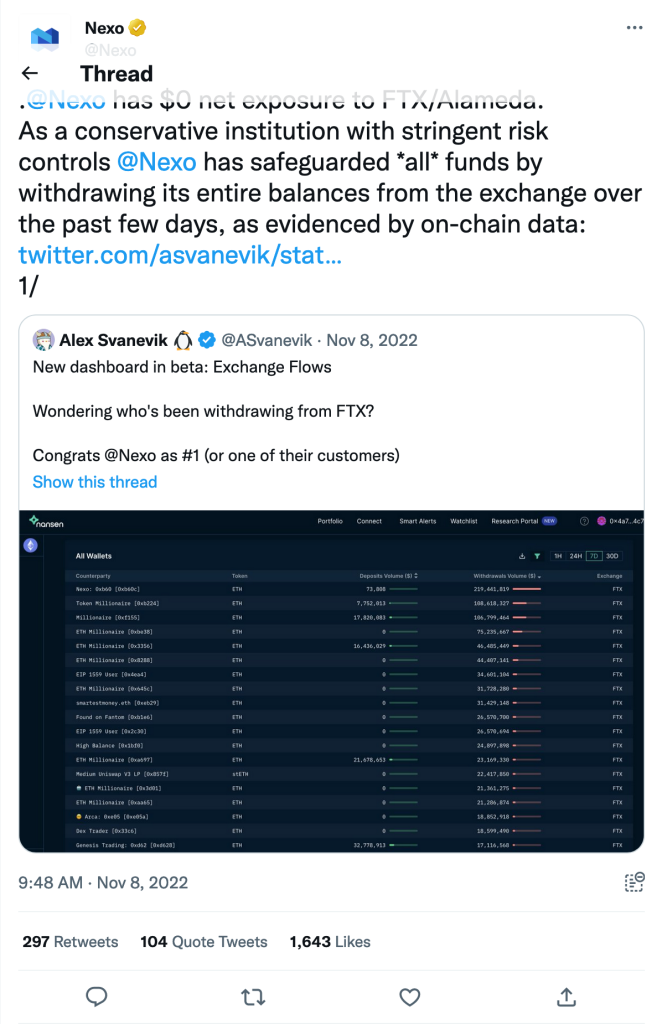

Interestingly, despite the close ties between Nexo and FTX, or perhaps precisely because of them, Nexo had no exposure when FTX filed for Chapter 11 bankruptcy, having conveniently and successfully withdrawn $219 million from FTX just prior to its insolvency. The company boasted of its move on Twitter on November 8: “@Nexo has $0 net exposure to FTX/Alameda. As a conservative institution with stringent risk controls @Nexo has safeguarded *all* funds by withdrawing its entire balances from the exchange over the past few days.” The move raises questions of insider trading given the close ties between the companies.

The Balkan will continue to follow this story.